This blog aims to demystify a persistent myth around homeownership. I want to dissect this myth and explain the reasons for my choices, which might surprise you. By exploring the hidden costs and financial implications of homeownership, I aim to offer a different perspective on the renter versus homeowner debate.

The Underestimated Additional Costs

When becoming a homeowner, people often forget the numerous additional costs that come with this status. Beyond the initial purchase price, there are transfer taxes, new furniture, curtains, landscaping, and much more.

Over the years, homeowners will also have to bear thousands of dollars annually in ancillary costs for their property, including insurance, maintenance, heating, and renovations. These costs can seriously reduce the return on a real estate investment and do not compare to the management fees of an investment portfolio. In fact, the costs that a tenant must bear to live (electricity, damage insurance, heating, etc.) are generally much lower than those related to a house.

There is a golden rule that says that notary fees, welcome tax, curtains, fences, landscaping, furniture, and other unforeseen expenses can represent up to 5% of the price of a house. To these costs, one must sometimes add those related to car ownership, especially if you live far from your workplace, as the maintenance and energy required to run it can be costly.

Comparing the cost of rent with that of a mortgage is a mistake. Remember this: the cost of rent is the maximum one pays for housing, while the mortgage is the minimum one pays for housing.

Table of Unexpected Costs for First-Time Buyers

New buyers completely neglect the associated costs. For a house valued at $600,000, here is an estimate of the associated costs based on the provided information:

| Type of Cost | General Estimate | House at $600,000 |

|---|---|---|

| Property appraisal fees | $350 to $800 | $600 (average estimate) |

| Inspection fees | $500 to $1500 | $1000 (average estimate) |

| Notary fees | $1500 to $3000 | $2250 (average estimate) |

| Sales tax on mortgage insurance premiums | For a $375,000 property = $1400 | $2052 |

| Mortgage insurance (CMHC - 5% of property value) | 15% of the final purchase price | $22,600 |

| Sales tax (new properties) | 0.5% to 3% of house value | $3000 to $18,000 |

| Welcome tax (transfer tax) | Starting at $500 (about 0.5% of house value) | $5000 (average estimate) |

| Moving costs (truck rental, movers, storage, insurance) | $150 to $800 | $500 (average estimate) |

| Title insurance | $150 to $800 | $300 (average estimate) |

| Curtains and blinds | $75 to $500 per window, depending on quality and size | $1000 (average estimate) |

| Appliances | Several hundred or thousands of dollars | $2000 (average estimate) |

| Various furniture | $1000 to $10,000 | $5000 (average estimate) |

| New coat of paint | Several hundred or thousands of dollars | $1000 (average estimate) |

| Urgent repairs or renovations | Several hundred or thousands of dollars | $5000 (average estimate) |

| Landscaping (fencing, lawn, shrubs, gardening equipment, pool, garden shed, etc.) | Several hundred or thousands of dollars | $1500 (average estimate) |

| Decoration (light fixtures, rugs, etc.) | Several thousand dollars | $3000 (average estimate) |

| Snow blower, lawn mower, various tools | Several thousand dollars | $3000 (average estimate) |

| Municipal and school taxes (annual costs) | About 0.50% | $3823.20 |

| Insurance (annual costs) | $400 to $800 | $700 (average estimate) |

In total, the costs for buying a $600,000 house could easily exceed $55,302 to $72,302, considering the various costs associated with the purchase, ownership, and initial maintenance of the property. These figures vary depending on the specifics of the property, region, and personal choices in terms of purchase and setup.

Urban Sprawl

In this economic context, households often have no choice but to settle far out in the suburbs. The average Canadian household spends 18.5% of its income on transportation, more than on food (14.9%) according to Statistics Canada. This lifestyle choice is expensive for the wallet, knowing that a car is an asset that depreciates as soon as the lease is signed. The idea of spending one-fifth of your income on an object (the car) that is used only 5% of the time and depreciates annually is completely illogical from a financial standpoint. At this price, opting for a public transit pass can save you thousands of dollars in the long run. With these savings, you could instead grow your TFSA and index ETFs.

The Myth of Bricks

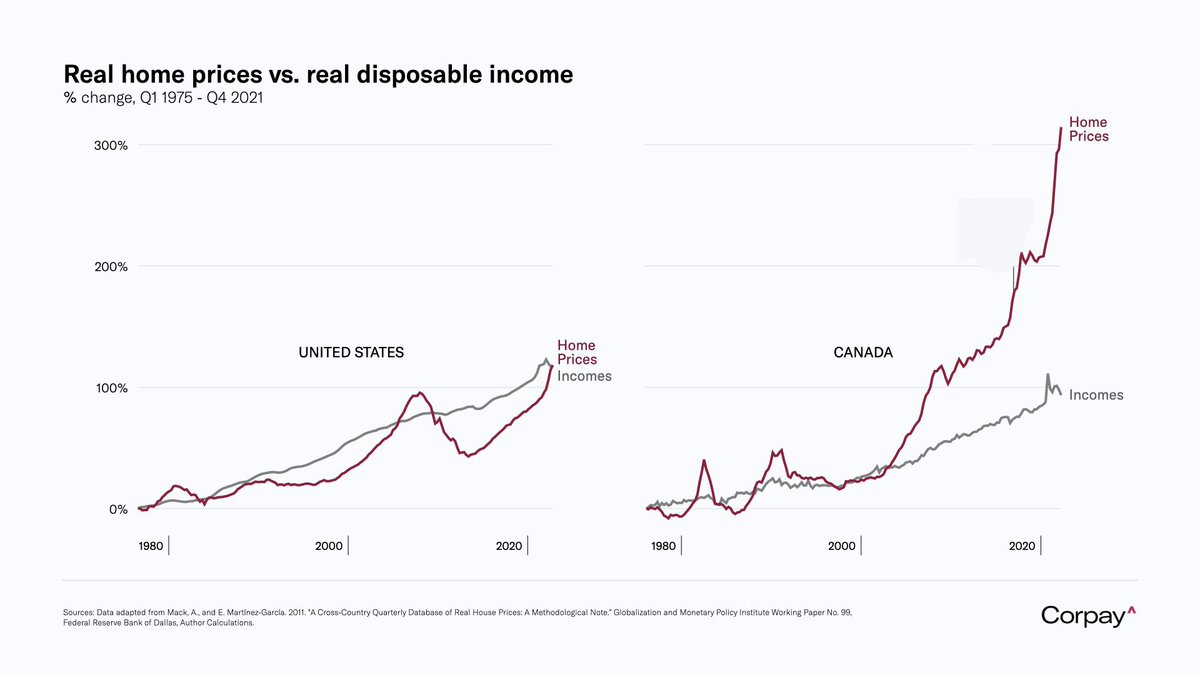

My mother always assured me that real estate was a safe investment, a belief rooted in the socialist influence she received. However, in the North American context, this idea always seemed doubtful to me. The myth of perpetual real estate price increases may be valid elsewhere, but it doesn’t hold in North America. History proves the opposite: between 1994 and 1996, the real estate market declined by 0.3% to 4%. In 2007, it dropped by 15%. Furthermore, between 1976 and 1982, then from 1988 to 1996, it took until 2002 to recover the losses caused by the downturn cycle that began at the end of 1987.

However, since 2002, real estate prices have significantly increased, far exceeding the average salary/average house price ratio. The older generation benefited from a much more affordable entry point, which is no longer the case for today’s buyers.

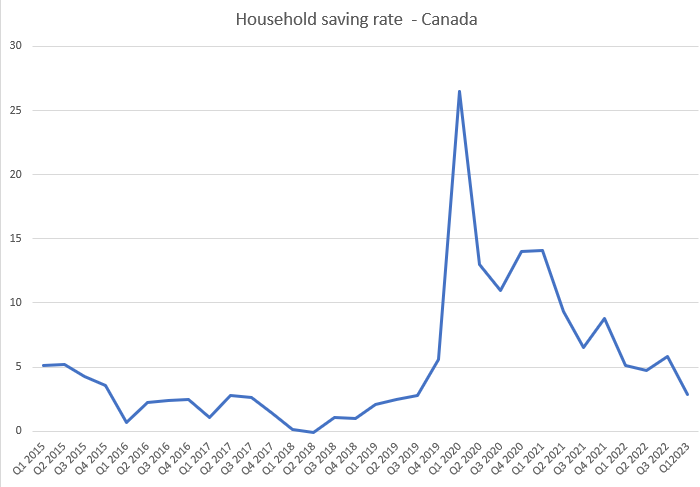

Over-Indebtedness

In recent years, many people have barely qualified for a mortgage and are at risk during periods of economic stress. Warren Buffet has a famous saying: “It’s only when the tide goes out that you see who’s been swimming naked.” This phrase makes perfect sense with the sharp rise in interest rates. Canadians are shaken by their mortgage payments, and the only solution for some is to extend the amortization period, thus enriching their banker with more interest.

Used Houses

If you are considering buying a house, be on the lookout for hidden costs and prepare in advance. Review this checklist:

Used House Purchase Checklist

Exterior of the House

- Condition of the siding (shingles, sheet metal, membrane)

- Adequate soffit ventilation

- Gutters securely fastened and sealed

- Condition and sealing of flashings

- Leaks and moisture stains on the chimney

- Cracks on the exterior siding

- Signs of rot under balconies

Plumbing and Electricity

- Plumbing in good condition

- Backflow preventer present

- Condition of the French drain and sump pump

- Age of the electrical panel (avoid fuses)

- Type of insulation used

Interior of the House

- Drafts near windows

- Check kitchen hood

- Types of cracks in the foundation

- Condition of the concrete or grout of the foundation (is it crumbling?)

- Signs of moisture

- Bathroom fans in good condition

Roof and Windows

- Date of the roof (original, warranty, date of renovation)

- Roof often prone to leaks?

- Date of window installation, warranties still valid?

History and Other Details

- Historical water damage

- Condition of the water heater

- Type of heating (electric, radiant)

- Presence of a humidifier

- Presence of mold in the basement

- Costs of property taxes, insurance, heating

- Building’s energy performance

- Check for easements (Hydro-Québec, Énergir, municipality)

- Condition of door, window, and shower caulking

- Check with the notary for unpaid taxes or fees

- Official dimensions of the land

Renting

Buying a house may seem like an excellent option to meet a family’s needs. However, the Canadian real estate market is currently paralyzed and overvalued due to various factors: low new construction rates, demographic changes, bureaucratic delays, and the greed of real estate developers. Rushing into a mortgage could be a costly mistake, as loan interest is often very high. Many people do not fully realize the long-term financial implications and are influenced by social pressure to acquire a “trophy home.”

In this context, renting becomes a wise option. Although some consider renting a financial loss, there is a more strategic alternative: systematic and disciplined saving. By investing in the stock market the $50,000 down payment, the $7,000 start-up costs, and the money saved each month, you can generate an annual return of 7% on an index ETF. This concept, called opportunity cost, illustrates that a $50,000 down payment invested at 7% could yield

$48,357.61. This avoids being tied to a mortgage for the next 30 years.

It is difficult to predict the future, but it is clear that this is not the best time for new graduates to invest in real estate. It is better to stay away during this uncertain period and increase your savings rate.

The world is vast and not limited to Quebec or its suburbs. You can explore other regions and find a property that meets your criteria. Additionally, you can also use my analysis tool available here: Coastal Escapade in the USA - Discover Affordable Housing Near the Ocean

Conclusion

My goal was to highlight the many hidden costs associated with buying a house. Often ignored or underestimated, these costs can become a significant financial burden. It is crucial to think long-term and calculate the opportunity cost of each financial decision.

To determine which scenario is most optimal for your situation, you can use this calculator: Home Buying Calculator

I fully understand the psychological need to have a house with a backyard and perhaps even a pool. However, from a financial perspective for someone in the middle class, I am not convinced that these life pleasures justify the associated financial burden. Children can create just as precious memories in a more modest apartment, enjoying the municipal pool or the park around the corner. Often, we are influenced by marketing that sells the idea of a basement with a playroom, but in reality, simplicity can offer much more benefits.

Buy me a coffee

Buy me a coffee